Fun with Call Centers and Bank Accounts

Friday January 11, 2013

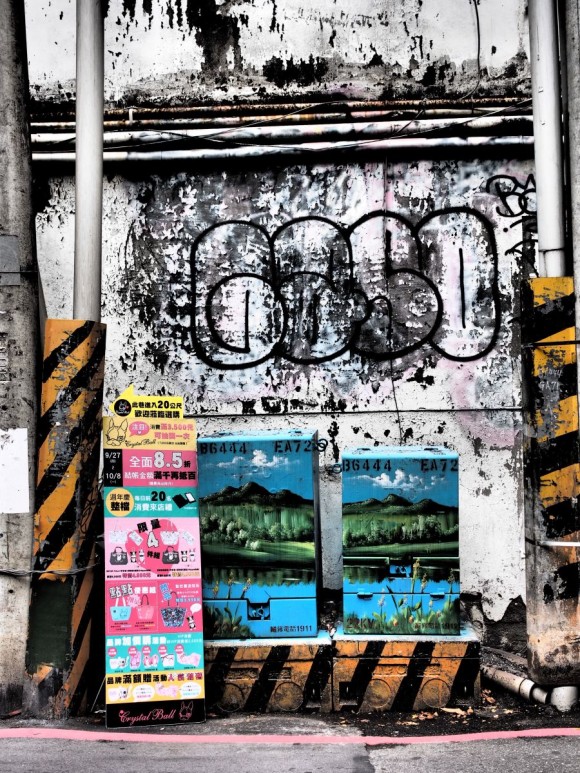

7:07 a.m. at the 7-11 on Bade Road

The weekend is almost upon me, and I’m very glad about that. It should have felt like a short work week since I wasn’t at work on Monday, but it has felt quite long. In an odd way, it hasn’t felt like a work week at all. My brain and heart have both moved on so far from work that I’m barely even conscious of having a job. I go in to the office and I do my thing. I proofread all morning yesterday and recorded all afternoon. However, I’m not invested at all. It’s hollow time.

I had a very interesting experience late last night. It was late at night and, I’d say, late in my life for that kind of experience. I say that because I’ve never come to grips with money in any way in my life. I’ve never taken it seriously or really thought about it much. I try as a rule to stay away from the cliché of regrets and hindsight and all that, so I won’t say that it was good or bad. It was just the way things were and the way I was. The result is what is important. And the result is that I have no financial life at all: no investments, no RRSPs, no pensions, no nothing. The sum total of my financial existence consists of three things: a chequing account in Canada, a credit card, and a bank account here in Taiwan. And that’s it, my whole financial world. Note that in my short list above there isn’t even a savings account. I probably need a savings account. Doesn’t everyone? But I just never got around to getting one.

Well, part of my preparations for leaving Taiwan is setting up some way to access money while in different countries. Opening up at least one more bank account has been on my to-do list for months if not years. I get very uncomfortable dealing with that sort of thing, so I kept putting it off and putting it off. I dislike doing things over the telephone, yet to deal with banks in Canada, I have to get on the phone.

Before I made the call last night, I went online and did a bit of research and wrote down some questions and some thoughts about it all. My initial goal was simply to open a savings account with the same bank with which I have my sole chequing account. I had this idea it would be very difficult if not impossible largely because I am physically in Taiwan. I imagined that the bank would want me to show up in person and sign forms. In short, I anticipated disastrous problems and a very uncomfortable situation.

The problems actually began before I’d even made the call. I use Skype for all my telephoning. I don’t actually have a real phone in my apartment, so Skype is my only real option. But when I launched Skype, I noticed that I only had about $1.50 in credit. I thought that would be enough to cover the call, but I wasn’t sure. I figured it would be a good idea to buy some more Skype credit. Skype credit comes, for whatever reason, in $14 units, and I clicked on the appropriate buttons to purchase more credit. This is routed through my PayPal account, and normally it isn’t a problem at all. I click on the button and within seconds, the credit pops up on my Skype account. This time, nothing happened. I waited and waited but my credit never showed up. I had no idea what was going on and that led to nearly an hour of just trying to figure out what the problem was with Skype before I could even call my bank. I eventually found the place on Skype and PayPal where I could review recent transactions. I wondered if my credit purchase had even registered with them. It had registered and it was sitting there with a status of “pending”. After much more research, I figured out what the problem was. In the past, I always had money sitting in my PayPal account. So my Skype credit purchase drew on the money that was sitting right there. This was money I’d gotten from the sale of various things on eBay. I’d eventually transferred the bulk of that money to my bank account and then my PayPal balance had gone down to zero. That shouldn’t be a problem since my PayPal is linked to both my bank account and credit card. When you use PayPal to purchase something, it simply goes to your bank account and gets the money there. But, and this is the problem, when it does that as opposed to accessing money right in PayPal, it takes longer. According to Skype, it could take up to 10 days to process my credit purchase. That seemed crazy to me, but there was nothing I could do about it. I had no choice but to delay my call to my bank or take the risk that I wouldn’t run out of credit.

I summoned whatever courage I had and started to dial my bank’s international number on Skype. That went smoothly, but suddenly there was a problem. I should have anticipated this, but I didn’t – I had called an automated system and I was then expected to make choices by pressing numbers on my telephone’s number pad. But I was on Skype and staring at a computer screen. There was no number pad. I listened to the automated message telling me to press 1 for this and 2 for that and 3 for that and to hold for an operator. I had a vague inkling that Skype had a number pad. I remembered using it before. But where the heck was it? I scanned the computer screen frantically trying to find it, like I was searching for the stop self-destruct code on some alien spacecraft. I saw a symbol down on the bottom that looked vaguely like a number pad. I clicked on it, and to my relief, a friendly and simple number pad popped up on the screen. By that point, I had forgotten which number I was supposed to press. Press 1 for what? Press 2 for what? I couldn’t remember. I figured that #1 was the likely choice and I pressed 1. I still don’t know what 1 meant, but it worked and the automated system then asked me to enter my bank card number. This was a new thing to me. Luckily, I’m not a complete idiot and before I made this call, I’d carefully arranged on my desk all my bank cards, bank books, ID, addresses, phone numbers, and everything else I could think of. I knew that the bank would want to confirm my identity and would ask me questions, so I’d have to have all this information at my fingertips. I don’t want to be one of those guys that calls a business and then in mid call has to go off and find documents and information. So I grabbed what I thought was my “bank card” and entered the number I thought they were asking for “followed by the pound key”. It is a very long number and I was pretty sure I was going to make a mistake while entering it, but I didn’t and when I pressed the pound key at the end, I was quickly connected to a human. Since I had entered my bank card number first, this human automatically had all my information right in front of him on the screen when the call was put through to him. And, since I was in Taiwan calling my bank in Canada on official business, it was only natural in this modern world that the human I was connected to was pretty clearly in India. I suppose he could as easily have been in Sri Lanka or Pakistan or Bangladesh, but his accent was basically from that part of the world. His English was good, of course, but he had just enough of that accent to kind of throw me and I found I had to concentrate that little bit harder to keep up with him. I was also a little bit distracted. Let’s face it. Money is embarrassing. I anticipated some embarrassment as I spoke to a Canadian at my bank about my pathetic financial life. Now, here I was talking with someone from India. I had been saving money while working here and most of that money was just sitting there in that chequing account. Out of pure laziness, I hadn’t even opened a savings account so that I could earn interest on it. I’m the dumbest person alive when it comes to money, but even I know it is really, really dumb to have money just sitting in a chequing account doing nothing – and certainly the amount of money I had in that account. In terms of the real world, I’m not talking about a huge sum. I work in ESL in Taiwan after all. Nobody is getting rich doing that. However, what did that amount of money look like to this fellow in India? I don’t know. Perhaps people who do his work in India are well paid and all that. In any event, it’s an amusing aspect of modern times that people in one part of the world end up talking to people in another part of the world about their bank accounts. I can just imagine this guy in India going home at the end of the day and telling stories to his family or friends: “Yeah, you wouldn’t believe the guy I talked to today. This dumb Canadian had thousands and thousands of dollars just sitting in his chequing account doing nothing. He was clearly a moron. He had no idea what he wanted to do or anything. I had to hold his hand through the whole process and explain everything to him. Those Canadians don’t deserve their good fortune. Man, what I could do with that money! This guy? He’s just going to blow it on some dumb bike ride. What a child.”

If all of this was going through this guy’s head, he was certainly well trained enough not to let any of it come through in his voice. The funny thing is that I was so aware of how false the situation was that I couldn’t stop thinking about it and analyzing it. Whatever he said or did, I started thinking about how that subject had come up in his training classes and how they discussed it and practiced it. For example, this guy was extremely friendly and chatty and personal. I liked it, but it felt kind of weird. I’m not used to official people being friendly and chatty. This guy asked personal questions in a very friendly manner and followed up on things that I said and we ended up talking about my plans for cycling around Asia and other parts of the world. “A dream of a lifetime, right, sir? It sounds amazing.” This came up because I had to put a security note on my bank accounts and credit card account that I would be traveling to different countries. When this guy started being so chatty and friendly, I felt a bit odd and I wondered how much of it was his training and how much was natural. Clearly, he would not be talking to me in that way if it wasn’t part of my bank’s policy. It was quite clear in my head because this idea has come up over and over again in movies and TV shows of late. I watched a sitcom called “Outsourced” about a call center in India. This dealt with training the people in India to talk to people from the United States. (Based on a great movie, also called “Outsourced.”) I also just recently watched the movie “The Best Exotic Marigold Hotel”, and one of the characters in that movie got a job at a call center in India, and her job was to train the employees there in how to be friendly and warm and chatty on the phone while talking to customers from the West. This involved a lot of cultural training and sensitivity training. My guy had clearly been taught to be super friendly and super open to taking the conversation wherever the customer wanted to go. He bent over backwards to allow me to say whatever I wanted. He was clearly working extremely hard to make me feel that he was willing to talk to me as long as I wanted, to feel comfortable about the business I wanted to transact.

In the end, I pretty much did everything that this guy suggested. It might not have been the absolute best thing for me, but no matter what, it was clearly a thousand times better than what I had been doing on my own. I think it helped that I had so much money just sitting in that account. With that much money, I could pretty much open up any account I wanted to and handle the sizable minimum deposits and that sort of thing. I got the impression there was a hiccup here and there, but this guy had the power to override them and ignore them. After all, if he didn’t make it easy for me to keep my money at this bank, I’d probably move on and put the money somewhere else. I started off wanting to just open a simple savings account. I was going to find out which type of savings account was the best and then open it and be done. My new banking friend in India had some other suggestions and I simply followed them. It basically involved opening a special tax-free savings account. This account has lots of advantages, not the least of which is a high interest rate. The trick is that you have to open it with a very large deposit. On top of that, he would open another savings account for me – their premium account which involved another fairly large minimum deposit. It was the account that I had been looking at originally, so I went for that, too.

I was amazed at how easy this was all turning out to be. He said he could open those two accounts for me right now over the phone and he would transfer the amounts of money we were talking about and it would all be done. Considering the amount of money we were talking about and how big a deal this was for me, I probably should have thought about it and done more research and all that, but I decided it was better to just get this done right now. I had the guy on the phone and I had started the process. If I didn’t follow through on it now, then when would I? So I agreed to this plan.

At that point, things got a bit more complicated and business-like. This tax-free account, for example, was quite a special financial instrument and it required paperwork to be filed with the Canadian government. The Canadian government is not going to let you earn tax-free interest for nothing. There have to be rules and policies and all that. So my friend in India started explaining all of these to me and he started mentioned all the documents that would mailed to me and how I’d have to read them and I’d have 14 days to do this and do that. I had to stop him at this point and confess that I was not physically in Canada and at my address of record. I was, in fact, in Taiwan. I had the sense that I had just dropped a hand grenade in his lap. He stopped and said that that might change everything. He would have to check. My heart sank. I knew that it had all been too easy. I knew that now everything would get complicated and things would go wrong. I was just waiting for that to happen the whole time. He put me on hold and said that he would have to check if he could open these accounts for me while I was not physically in Canada. Suddenly, I was listening to “hold” music. To my relief, when he came back on the phone, he said nothing about any problems. Apparently, it was okay to proceed and he went on explaining all the restrictions and terms of my new accounts. This went on, I have to say, for an uncomfortably long time and involved a lot of numbers and percentage points and fees and penalties. It was all the stuff that he was required by law to tell me. And I was required by law to give a verbal assent of understanding and agreement to all these things. He kept saying that this would happen and did I agree? Yes, I did. This document would have to be filed. Did I agree? Yes, I did. I have to give permission to the bank to check my credit rating. Did I agree? Yes, I did. There was a lot of this, and I understood very little of it. Yet, I wasn’t that worried. It was a bit like all the side-effects that must be listed with every drug – by law all this has to be done and explained. At least I hope I didn’t agree to anything that will come back to haunt me.

When I got off the phone (off Skype), I felt drained and a bit relieved, like a weight had been lifted. Perhaps I could have done something smarter with my money – invested it in some stock that would make me rich – but wherever that bit of money ends up, it is at least in a better and safer place than it was before that phone call. And going through this very official process again focused me on my plans and made them more real. Just as riding my bike down to the bike shop the other day suddenly brought the physical nature of my planned trip into focus, this opening of bank accounts brought home the reality of money and how it should be taken seriously.